Cambridge is launching a new investment fund that will help support new companies based on University research. The fund, a combined Enterprise Investment Scheme (EIS) and Seed Enterprise Investment Scheme (SEIS) fund, will enable alumni and friends of the University to support the development of Cambridge spin-outs, while benefitting from generous tax incentives.

Last year’s fund has made investments in four University spin-out companies to date: Cambridge CMOS Sensors, DefiniGEN, Inotec AMD and Sphere Fluidics. These companies are working in areas including healthcare, stem cells, microsensors and drug discovery. It is expected that the first Fund will be fully invested in the coming months.

Early-stage funding is incredibly limited, and programmes such as the Enterprise Fund enable young companies to grow and contribute to the continued success of the Cambridge cluster.

Dr Anne Dobrée

There has been increased interest in this year’s fund, which will be invested over 2013-14 tax year. Investments may be used for proof of market, seed funding or follow-on funding.

“The response from University alumni and friends to last year’s Enterprise Fund was outstanding,” said Dr Anne Dobrée, Head of Seed Funds at Cambridge Enterprise, the University’s commercialisation office. “Early-stage funding is incredibly limited, and programmes such as the Enterprise Fund enable young companies to grow and contribute to the continued success of the Cambridge cluster.”

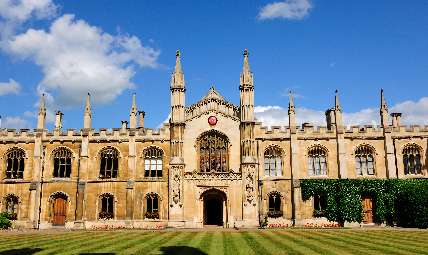

Cambridge is Europe’s most successful technology cluster, having produced 12 companies valued at more than $1 billion, two of which are valued at more than $10 billion. The vast majority of these companies are connected to the University in some way: they are either based directly on University research, are founded or staffed by University graduates, or work collaboratively with University researchers to find solutions to business problems. University portfolio companies have raised more than £1 billion in follow-on funding.

The SEIS was announced in the 2012 budget as part of the government’s strategy for stimulating economic growth. The scheme allows individuals to invest in new companies while benefitting from generous tax incentives. Last year’s SEIS fund was the first to be launched by a university, and the first to combine the SEIS with the more established EIS. The University of Cambridge Enterprise Fund is managed by London-based investment firm Parkwalk Advisors, on behalf of Cambridge Enterprise.

“Parkwalk is delighted to continue to assist the University of Cambridge in raising capital to fund investment in early stage companies and thereby leverage the high quality research conducted at the University.” said Alastair Kilgour, Founder, Parkwalk.

University entrepreneurs who are interested in applying for funding, or would like further information, are asked to contact Cambridge Enterprise’s Seed Funds team on 01223 763723 or CESF@enterprise.cam.ac.uk.

Photo credit: University of Cambridge by llee_wu via Flickr