This year’s theme for International Women’s Day emphasises embracing equity, acknowledging different circumstances, and allocating resources appropriately.

The concept of equity recognises the variety of lived experiences, circumstances and backgrounds that enables us to formulate long-term and sustainable solutions. This differs from conversations on equality, which argue for giving everyone the same resources and opportunities, sometimes overlooking specific needs.

The venture capital sector is not known for its variety of investments in diverse groups. In fact, it has had a well-documented history of bias and almost impressively blinkered outlook. The persistent and damaging stereotype of the modern founder, a self-assured, solo-working male genius, has captivated venture capitalists and resulted in a disproportionate influence on where we invest and how much. Indeed, I have had conversations with people around the area of sustainability and investing, my specific area of interest, where I have been told not to worry, that the rapid decarbonisation problems we face will probably soon be solved by an exceptional (always suggested to be male) undergraduate and his friends who sit around after class, talk, and work it out. This would be a comforting thought if it didn’t completely disregard the rest of the population or suggest that there is one answer to an incredibly multifaceted problem.

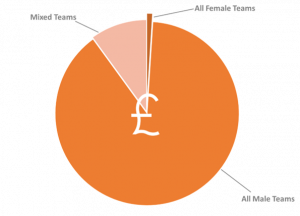

There has been a large amount of eye-opening research in recent years looking at where invested capital tends to flow. A comprehensive report put together by Extend Ventures analysed the data on UK venture capital investments for companies founded between 2009 and 2019. In this period, 68.33% of the capital raised across the seed, early and late venture capital funding stages went to all male teams. Of the remainder, 28.80% went to mixed teams and 2.87% to all-female teams. Extend Ventures also found significant discrepancies in the ways that women of different backgrounds were funded. Black women received just 0.02% of venture capital investment over this period. Female founders in general received 11%. The study demonstrates how understanding the relationship among demographic factors, such as ethnicity, gender, and educational background, is crucial for equitable funding to reach founders.

Currently, venture capital is a demoralizingly homogeneous landscape. Research into the area shows that 58% of people working in the area are white men, and together they control 93% of venture capital money invested. White women control the second largest amount at 3%.

This homogeneity, coupled with implicit bias, creates a vastly different landscape for female entrepreneurs to navigate. One metric illustrating the shocking discrepancy in funding states that for every £1 of venture capital in the UK, all-male teams receive 89 pence and mixed teams receive 10 pence. The remaining 1 penny is for all-female founder teams.

A heavily cited study of the language used in government venture capital decision-making meetings in Sweden demonstrates the crucial ways in which we close the door on women, often without realising it. Researchers were given access to 36 hours of conversations, held between 2009 and 2010, to see if there were discrepancies in how male and female founders were judged. In general, women’s credibility, trustworthiness, expertise, and knowledge were questioned, while men were described as being innovative, assertive, competent, knowledgeable, and as having established networks.

The study also found that 53% of women had their applications dismissed compared to 38% of men. The female applicants who were successful received, on average, 25% of the funding amount they had applied for. The men whose applications were successful received 52%. Male founders were praised for being ‘young and promising’, while female founders were discouraged for being ‘young, but inexperienced’. In men, caution led to them being seen as ‘sensible and level-headed’, but with women, it reflected poorly on their ability to take risks.

Investing in diverse teams should be seen simply as good business practice, not a rarity or a box-ticking exercise. From a 2019 dataset, McKinsey determined that companies whose boards were in the top quartile of gender diversity are 25% more likely than the fourth quartile to have above-average profitability. The reasoning behind this makes absolute sense. Companies without diversity in their management teams fall prey to groupthink and reinforcement of ideas that may be wildly out of touch with consumers’ needs. Being able to debate ideas healthily among a group leads to better thought-out decisions, and of course, diversity of people is directly linked to diversity of perspectives.

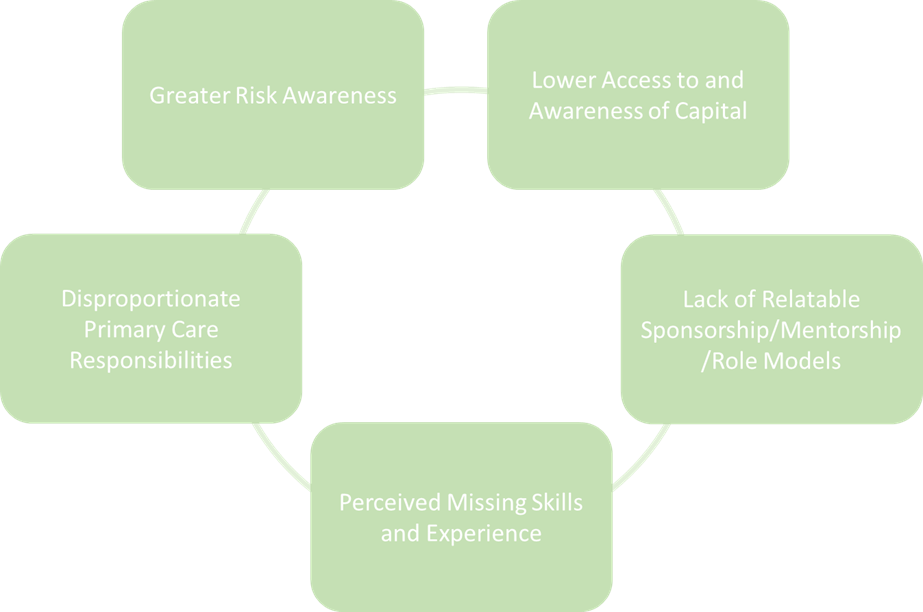

When it comes to raising capital, interesting trends have been observed with female founders. In general, female founders are more likely to rely on bootstrapping, meaning they prefer to establish a company with only personal finances. Indeed, women are three times less likely to approach venture capitalists or angel investors than men. This has been attributed women’s risk-aversion when making business projections and could hinder the ability of a business to grow. However, the assumption that women are overly cautious is a harmful stereotype that ignores the fact that while both men and women take risks, they may not pay off in the same way. Women report more negative consequences of their risk-taking behaviour in work, while men report more positive consequences, thus creating learned behaviour for the future. Women are frequently penalised for behaving in unexpected ways. This was highlighted in 2019 when the UK Treasury commissioned an independent review, The Rose Review of Female Entrepreneurship, which outlined five key barriers that lead to lower rates of entrepreneurship amongst women.

The review also found that access to funding was viewed by women as the largest barrier to entrepreneurship, with women being 81% less likely than men to feel that they can access the necessary start-up funds. UK women would also typically estimate needing 40% less funding to launch their businesses, and on average would start a business with 53% less capital than men.

University venture capital comes with its own unique set of challenges that set it apart from the general funding environment. It is difficult to claim high levels of diversity in spin-out investing when universities, especially those within the Russell Group, have a recorded history of exclusivity and bias. The challenges faced by minoritized groups and women begin well before an application for admission would be submitted and continue throughout higher education. While some steps have been taken to try to improve a severely skewed system, much of it still falls short.

In the UK, we see evidence of many white middle-class women being the main beneficiaries of equalities policymaking. In the context of higher education, 23.9% of professors are white women, and 2.1% are black and Asian minority ethnic women. Much of the statistics would suggest that while it is becoming easier to speak about women’s career progression, we are still shying away from conversations around race and intersectionality. This results in mono-ethnicity and a lack of gender diversity within academia that transfers into mono-ethnicity and lack of gender diversity in spin-out companies.

In this university spin-out space, early investment into research and development at a point that is deemed too risky by traditional venture capital is critical. This early-stage support, however, is subject to the same biases and patterns seen with later-stage investors. Considering the complex barriers to entry that women and people of diverse backgrounds face before getting their foot in the door, it is no surprise that the higher up you go on the academic ladder, the less representation there is.

Returning to International Women’s Day, there are many ways that we can support the advancement of women and those from diverse backgrounds in the workplace and in our daily lives. Mentoring and sponsorship play crucial roles here. In the start-up space, pairing women and minoritized founders with individuals who have a breadth of knowledge and contacts goes a long way in opening doors. Additionally, 89% of people who have been mentored will go on to mentor others, promoting upwards mobility. It is unreasonable to assume that any of us could achieve career success in total isolation. Networks and guidance are crucial.

Finally, within venture capital, we need more female and diverse decision-makers to avoid the pitfalls of groupthink. Morgan Stanley, in its 2019 assessment of 200 US-based VCs, found that when firms are presented with the opportunity to invest in a woman or diverse founder, they are unyielding in applying their definitions of ‘fit’. This is ironic in a sector that should be pushing boundaries and seeking new opportunities.

Cambridge Enterprise Seed Funds invests into new companies started by staff and students at the University of Cambridge to enable commercial development of research. We are committed to supporting high impact start-ups and founders from a range of backgrounds. Please feel free to speak to us if you have an idea you would like to discuss, or if you have any thoughts on how we can make our processes more accessible.