Supporting University of Cambridge spinouts since 1995

We’re celebrating 30 years of University venturing into Cambridge spinouts, from pioneering investments in the 1990s to today’s cutting-edge startups. Explore the milestones, the numbers and the stories that have shaped Cambridge Enterprise Ventures in our 30th anniversary report.

Since its launch in 1995, the University Venture Fund has supported more than 210 startups and spinouts with strong links to the University, whether through founders, technologies or research. The report reflects on the fund’s journey, its role in shaping Cambridge’s innovation ecosystem and the remarkable companies that have grown with its backing.

We are celebrating three decades of investment, starting with the vision of University Treasurer Joanna Womack and carried forward by the University, Cambridge Enterprise and Investment Committee. From early investments in Cambridge Display Technology and CADCentre to recent successes like Riverlane, Xampla and T-Therapeutics, the fund has backed ideas with global impact. These ventures have advanced science, driven social change and helped shape Cambridge’s reputation for innovation.

The results are impressive. The fund has invested £55 million, recycled £44.5 million back into its portfolio with portfolio companies raising £3.5 billion in follow on funding. With 66 exits and a capital leverage ratio of 1:64, Cambridge Enterprise Ventures continues to deliver strong returns and long-term value.

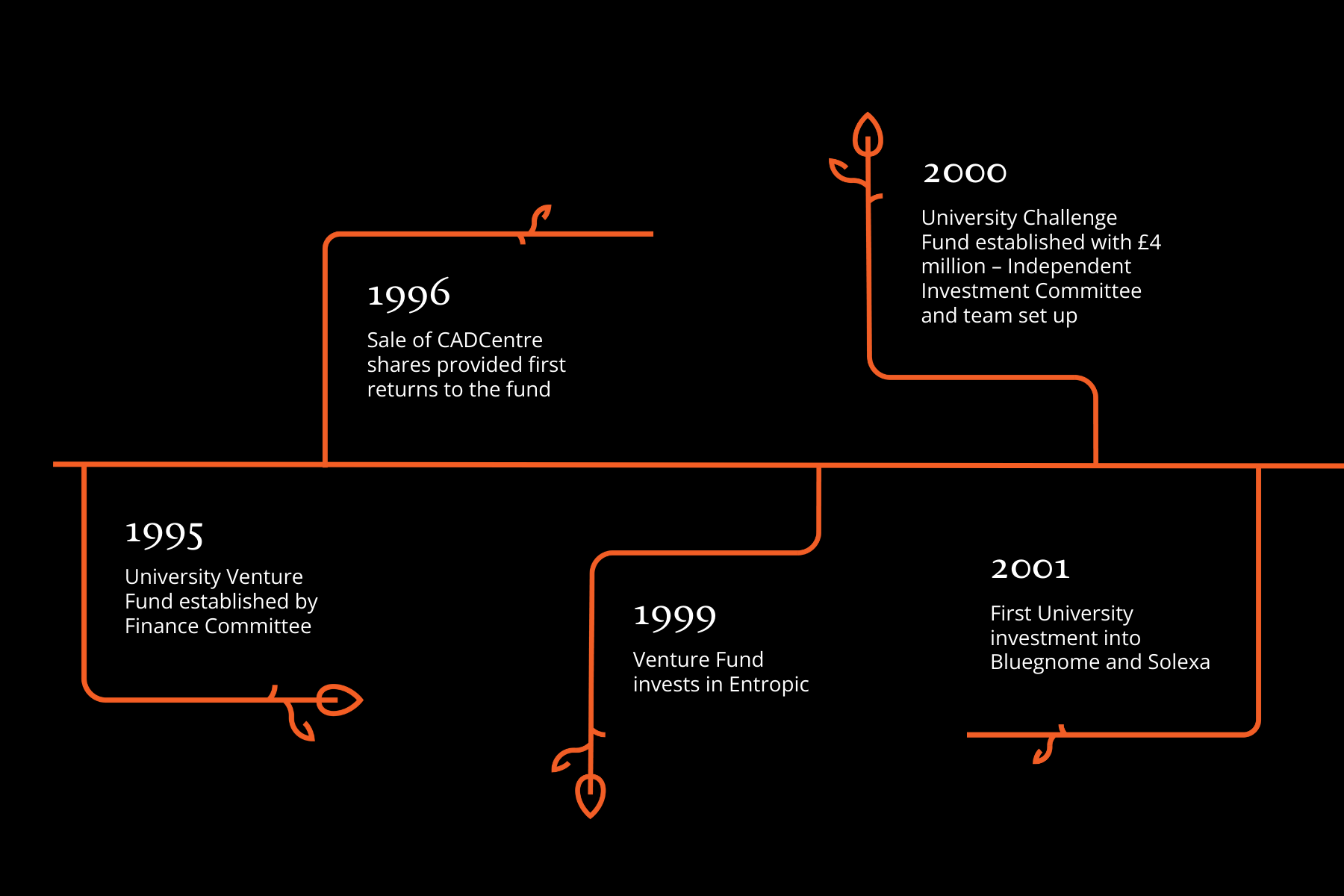

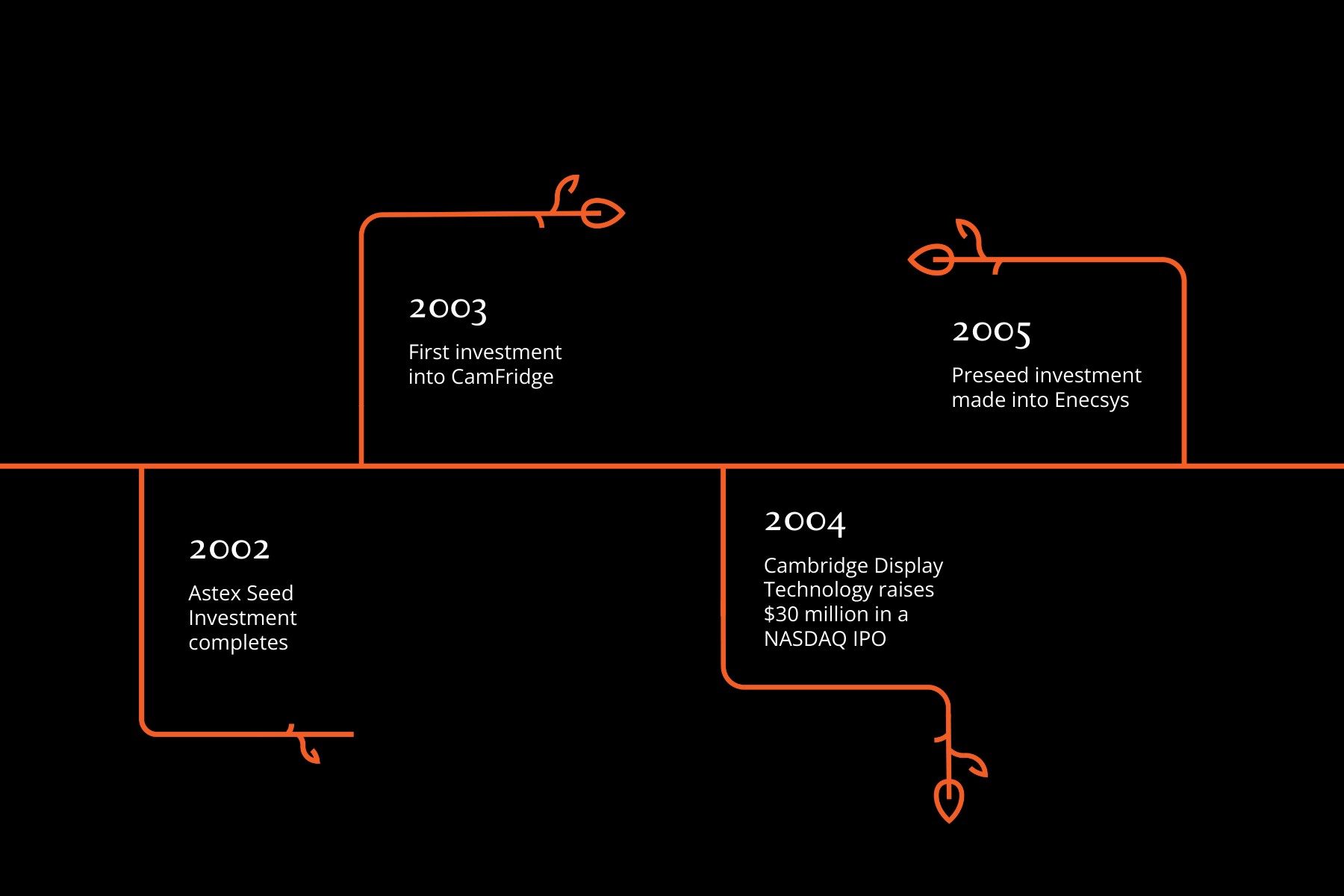

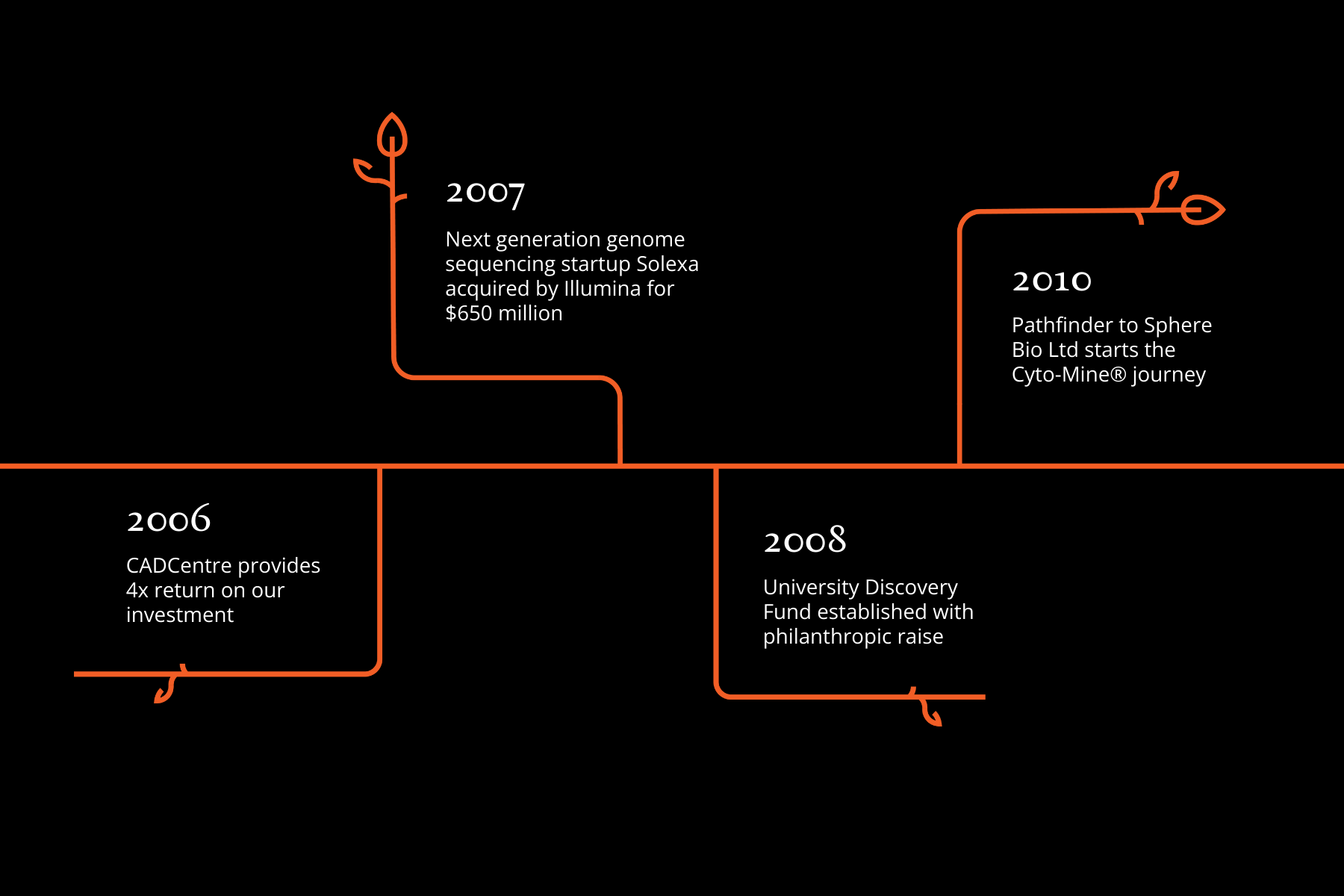

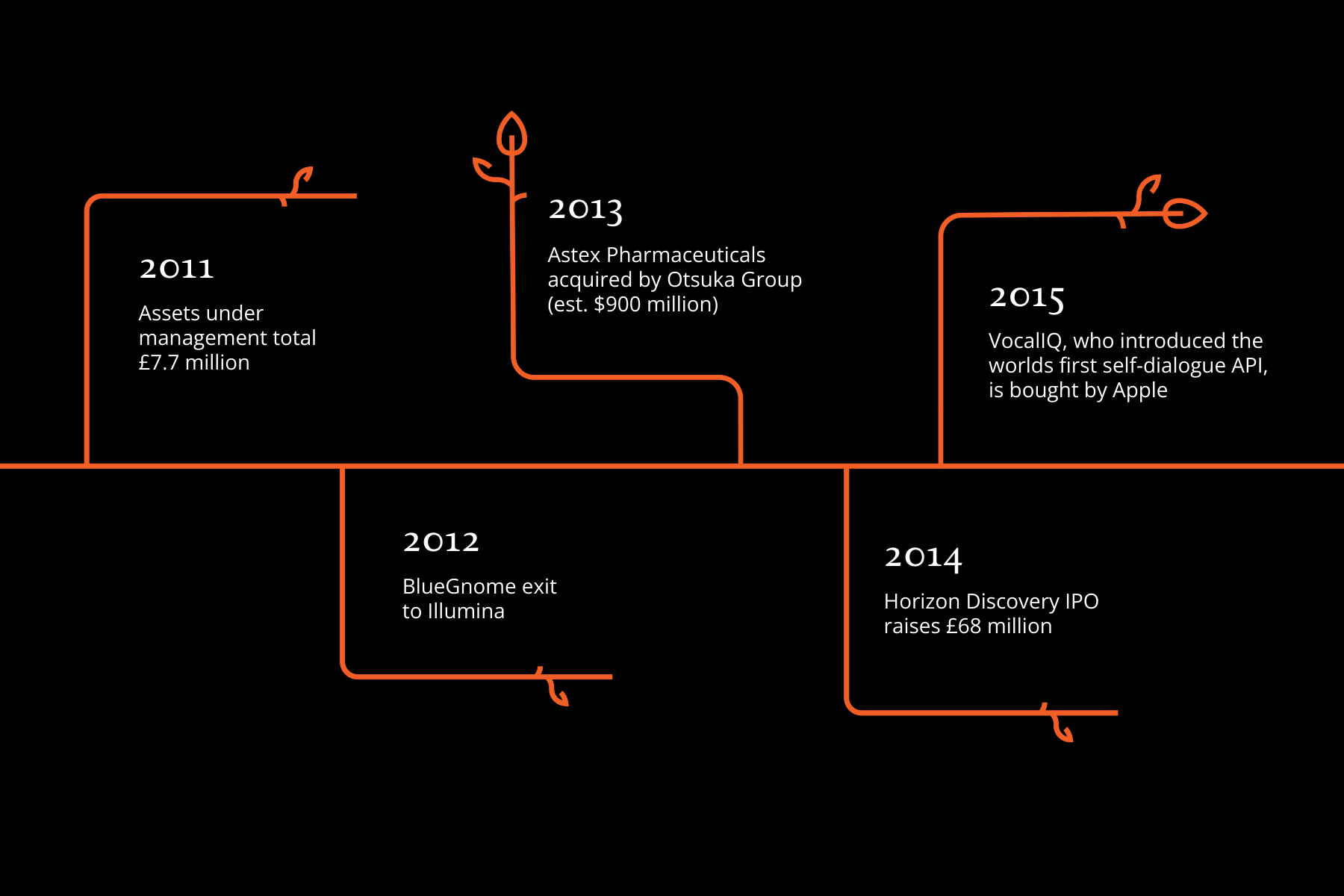

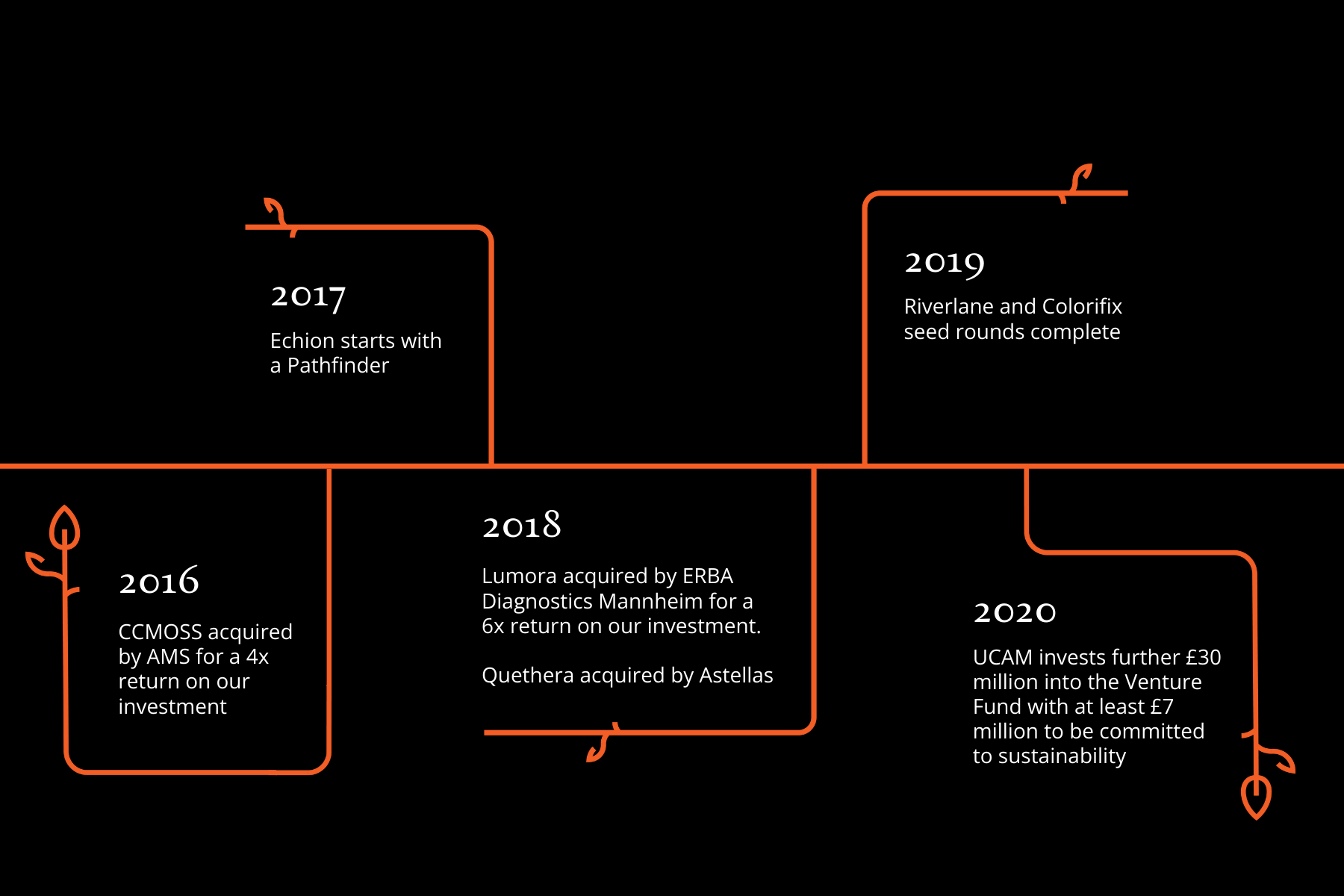

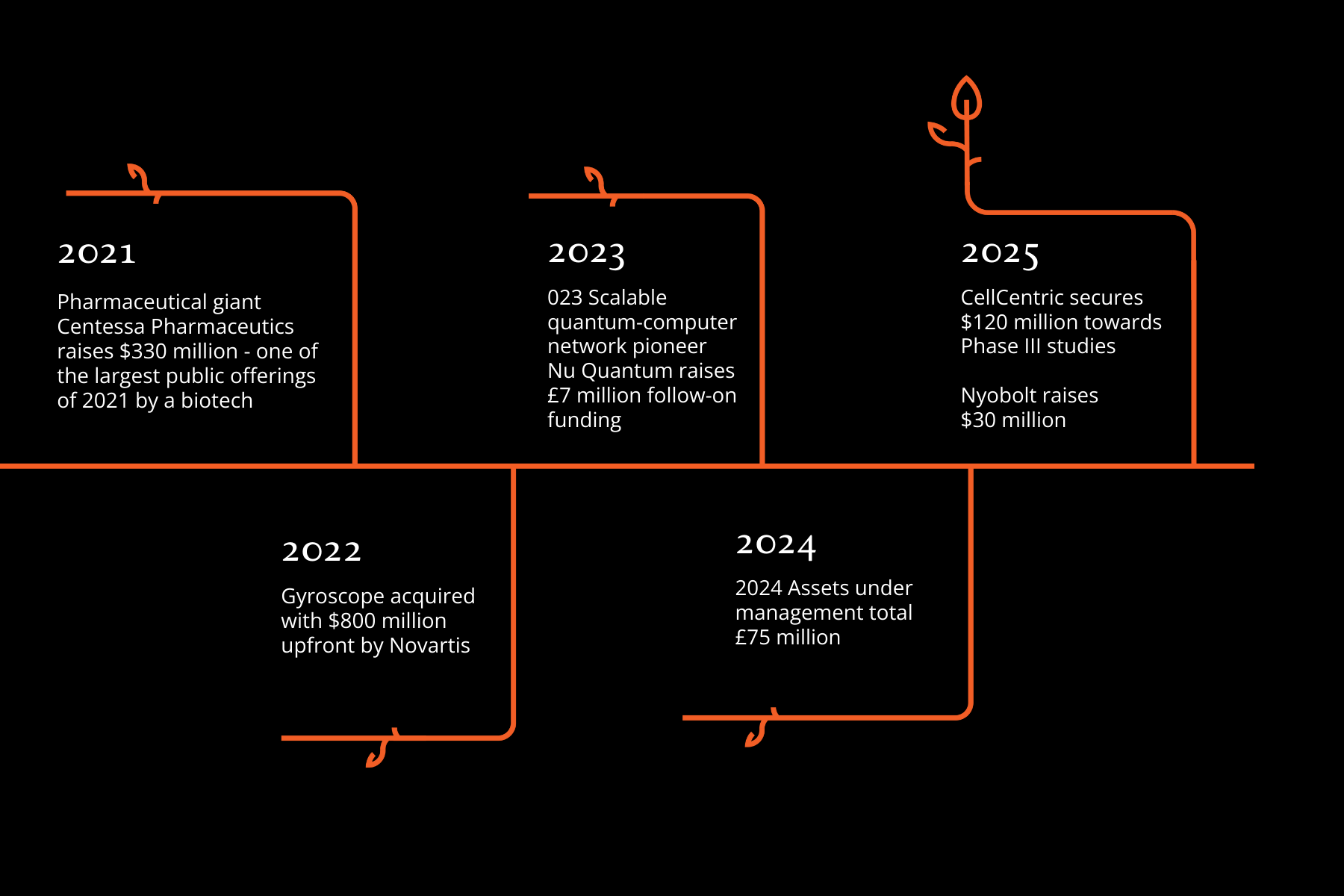

The history of the fund

The University Venture Fund was created in 1995 by the University of Cambridge’s Finance Committee to manage direct investments into spinouts and startups. Early successes like Cambridge Display Technology and CADCentre helped build momentum, with returns reinvested to support future ventures. In 2000, the University secured £4 million in Challenge funding, followed by the Discovery Fund in 2008, which raised £1.8 million to back research-led innovation.

Over the years, the fund has supported a wide range of companies across life sciences, physical sciences and more recently sustainability and social ventures. Notable exits include Solexa, acquired by Illumina for $650 million and Gyroscope Therapeutics, acquired by Novartis for up to $1.5 billion. Other standout ventures include VocalIQ, XO1, Quethera and Cambridge CMOS Sensors, each delivering strong returns and advancing Cambridge’s reputation for world-class innovation.

Click through the carousel below to go through the 30 years of University Venture Investing.

Our current portfolio

Cambridge Enterprise Ventures continues to invest in high-impact, University-connected companies across life sciences, physical sciences, sustainability and social ventures. In the year to July 2025, the fund completed over 30 transactions into 25 unique companies, with cheque sizes ranging from £20k to £500k. Highlights include new investments into the START cohorts and follow-ons into Nu Quantum and Xampla, reflecting a growing focus on both early-stage innovation and portfolio scale-up.

Life Sciences portfolio

Over the past 30 years, Cambridge Enterprise Ventures has built a strong and enduring Life Sciences portfolio. With £21 million invested into 101 companies, the fund has consistently backed research-led innovation across therapeutics, diagnostics and medical technologies. This long-term commitment has helped leverage over £2 billion in additional investment and continues to support breakthroughs in patient care and scientific discovery.

Successful exits include Gyroscope Therapeutics, acquired by Novartis for up to $1.5 billion, XO1 with a >13x realisation multiple and Solexa, whose DNA sequencing technology transformed genomics and was acquired by Illumina for $650 million.

Physical Sciences portfolio

The Physical Sciences portfolio has been a core part of Cambridge Enterprise Ventures since its earliest days. Over 30 years, the fund has invested £19.5 million into 77 companies, helping to leverage over £1.1 billion in additional investment. This long-term commitment has supported innovation across quantum computing, semiconductors, AI and advanced materials, with a growing focus on scalable technologies and commercial impact.

Notable successes include VocalIQ, whose voice recognition software was acquired by Apple and integrated into Siri, Cambridge CMOS Sensors, which delivered a >4x return before being acquired by ams AG, and Cambridge Display Technology, the first University of Cambridge spinout to list on NASDAQ, later acquired by Sumitomo.

Sustainability portfolio

The Sustainability portfolio is a newer focus for Cambridge Enterprise Ventures, reflecting a growing commitment to backing science-led solutions to environmental challenges. Since 2020, the fund has invested £10 million into 24 companies, leveraging £320 million in additional investment. This portfolio supports innovation in areas such as clean energy, sustainable materials and climate resilience.

Current examples include Echion Technologies, which is scaling fast-charging niobium-based battery materials from its base in Sawston, Cambridge and Colorifix, whose biological dyeing process is transforming textile manufacturing by reducing chemical use and water consumption.

The young & the future

Cambridge Enterprise Ventures continues to invest in the next generation of University-connected companies. Each year, around £5 million is committed to early-stage ventures, with support ranging from business planning and investor introductions to board expertise and follow-on funding. This long-term, evergreen approach ensures that today’s ideas have the backing they need to become tomorrow’s breakthroughs.

Social Ventures

The fund has begun building a growing portfolio of social ventures, supporting businesses with a core social mission. These companies address challenges from conflict resolution to access to clean water, combining commercial potential with meaningful impact. Kalamna Global, for example, is helping families connect with their heritage through Arabic language learning, using research-led tools developed at the University.

Founders at the University of Cambridge

Founders at the University of Cambridge is a strategic initiative delivered by Cambridge Enterprise to equip early-stage entrepreneurs with the skills, networks and funding needed to succeed. Through programmes like START, SPARK and SYNC, founders receive intensive mentoring and access to a global community of experts. Many of these ventures go on to receive direct investment from the fund, helping to turn research into real-world impact.