For the fourth year in a row, the University of Cambridge has broken its early stage investment record, approving 14 seed fund investments for a total of £5.3 million, an increase on the £3.8 million invested in 2014/15. This new funding follows another successful year highlighted by the exits of VocalIQ, Lumora and Cambridge CMOS Sensors Limited. During this period, the University received £6.2 million from realised investments.

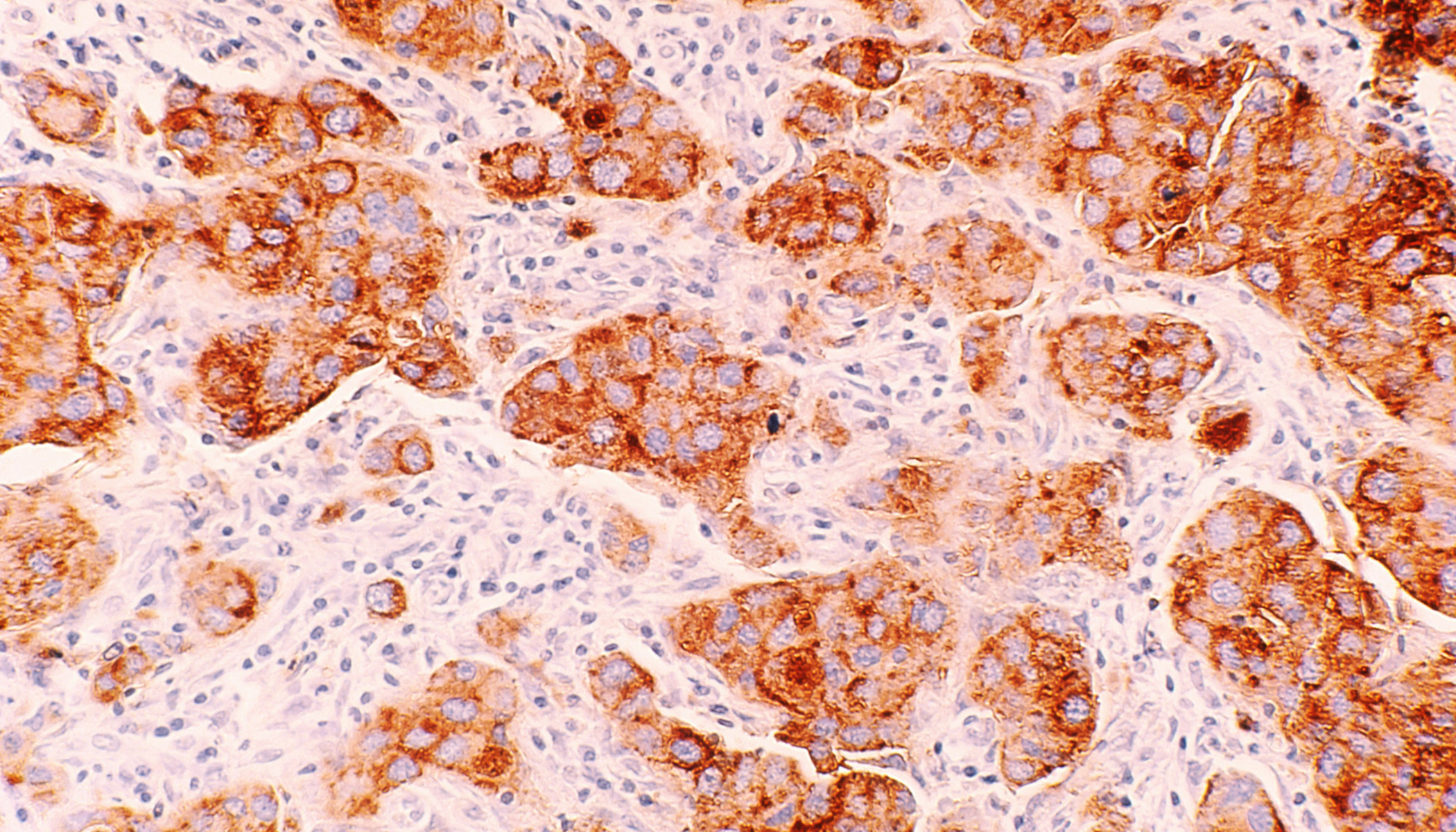

The new investments will progress Healthera, a company focused on next-generation, pharmacy-integrated personal health management solutions; PervasId, a passive UHF RFID reader technology start-up that enables highly reliable reading of standard, off-the-shelf passive UHF RFID tags; Psyomics, a spin-out working to improve the prevention, diagnosis and treatment of neuropsychiatric disorders; Carrick Therapeutics, a unique new venture bringing together world-class cancer research and drug experts with the aim of building Europe’s leading oncology company; 8power, which is developing smart sensors for industrial applications and Fluidic Analytics, which is developing a proprietary technology to characterise proteins in a rapid, accurate and cost-effective manner and successfully completed a Series A funding.

The amount invested this year in new companies is indicative of the number of quality proposals our Seed Funds is evaluating. As a result of increased deal flow this year, the Seed Funds team has added three new members.

Anne Dobrée, Head of Seed Funds

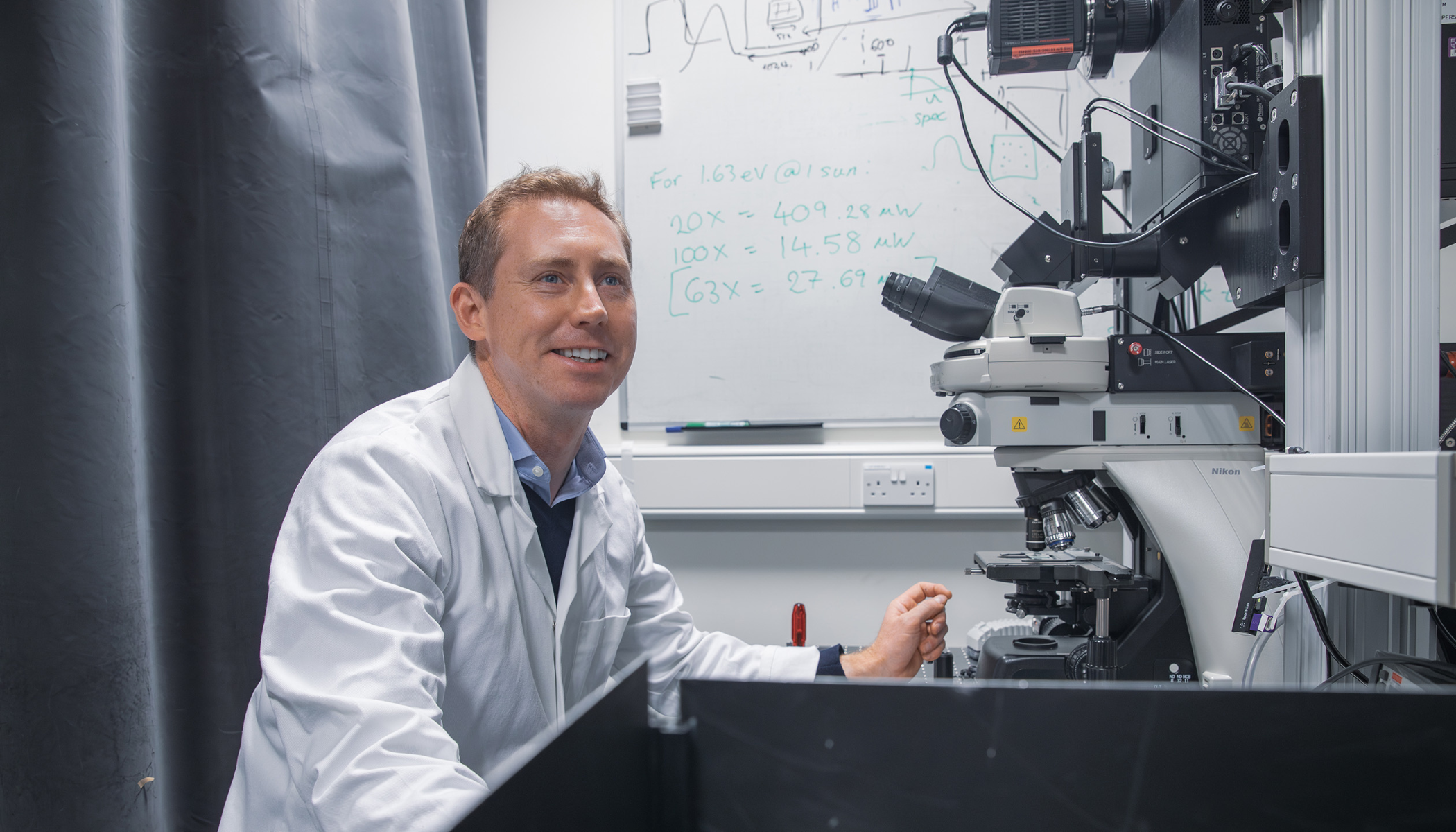

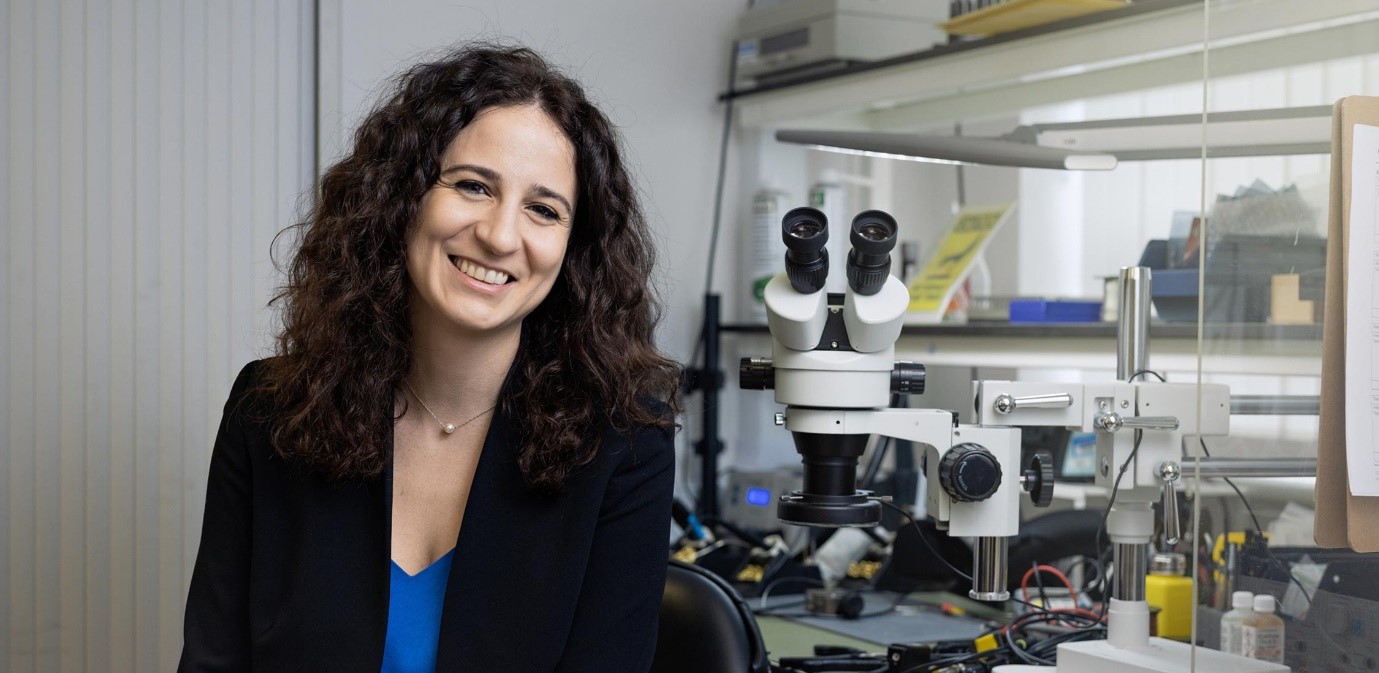

Anne Dobrée, Head of Seed Funds, said “The amount invested this year in new companies is indicative of the number of quality proposals our Seed Funds is evaluating. As a result of increased deal flow this year, the Seed Funds team has added three new members.” These are Dr David Holbrook, who has 18 years of experience with Life Science university spin-outs; Dr Elaine Loukes, who has been working in early stage tech investment since 2001; and Tania Villares Balsa, who previously worked in the venture capital sector in Spain investing in technology spin-outs from universities and research centres for over six years. Additionally, an Entrepreneur-in-Residence programme has been launched to assist the development of new ventures.

This was the fourth year of operation for the Enterprise Fund, which was announced as part of the SEIS programme in the government’s 2012 budget, established to stimulate economic growth. UCEF IV has invested £2.15 million across seven companies in a period of seven months. A fifth Enterprise Fund will be launched at the end of 2016. Cambridge Enterprise’s sister organisation Cambridge Innovation Capital co-invested alongside Cambridge Enterprise in three of the investments, PervasId, Carrick Therapeutics and Fluidic Analytics.

Cambridge Enterprise Seed Funds provides young companies with vital links to management and sources of further funding. Over £1.5 billion of follow-on funding has been raised by the University of Cambridge spin-outs in the Cambridge Enterprise portfolio.

Cambridge is Europe’s leading high-tech cluster with over 4,300 knowledge-intensive firms employing over 58,000 people and with a total turnover in excess of £11 billion. The majority of these companies are connected to the University in some way: either based directly on University research, founded or staffed by University graduates or working collaboratively with University researchers to find solutions to business problems.