Universities and investors have joined forces to boost the number of software spin-outs from academic innovations by recommending faster deals with less friction, built for rapid scaling.

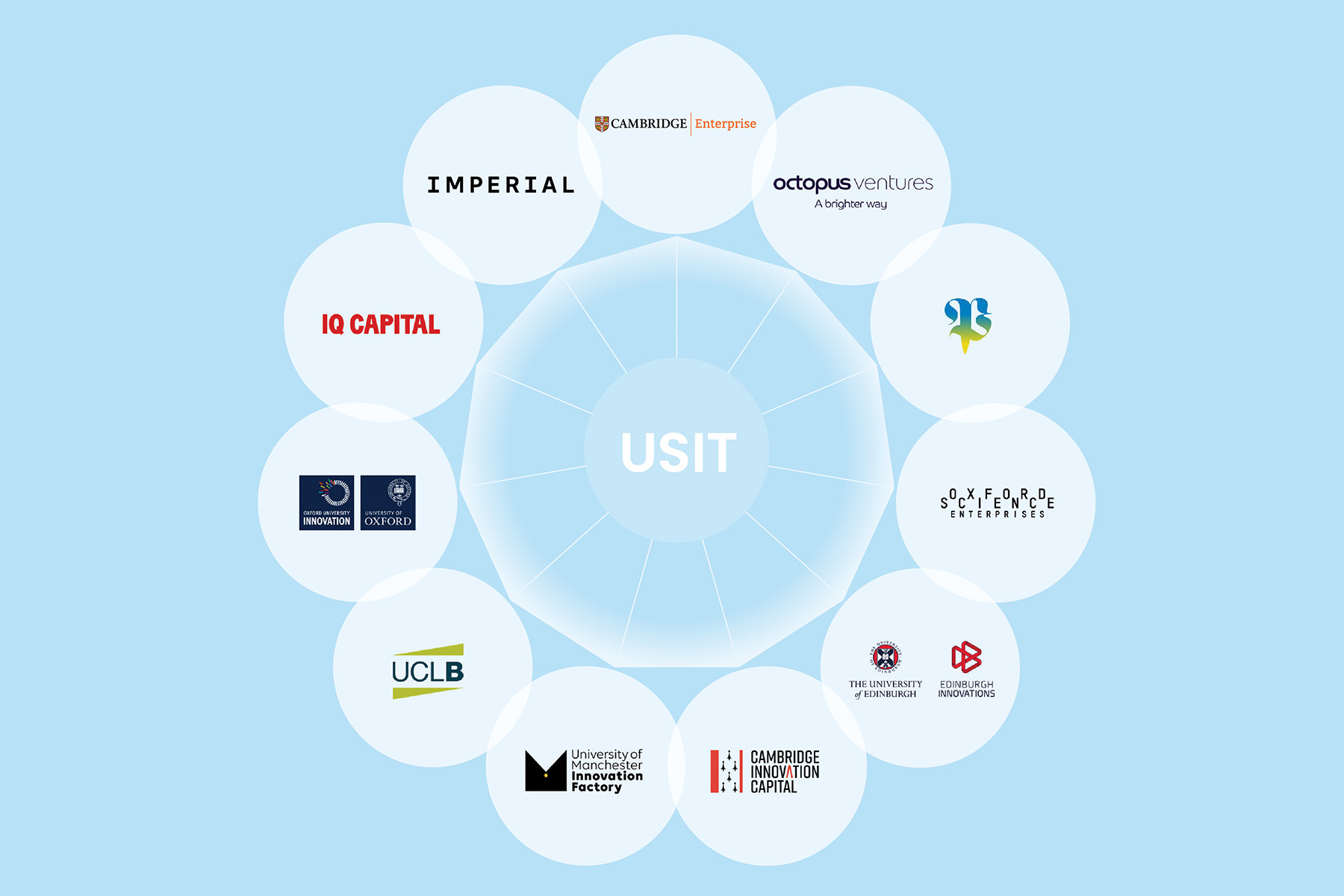

TenU – which represents world-leading universities including Imperial, Cambridge, Oxford, UCL, Manchester and Edinburgh – has joined forces with a group of top investors and professional services firms to launch a new expert guide for the speedy and efficient formation of spin-outs from cutting-edge university research.

The USIT for Software Guide was launched on 20 May at an event at Mansion House attended by Andrew Griffith, Minister of State at the Department for Science, Innovation and Technology.

“Software businesses evolve through relentless engagement with customers, understanding their new needs and spotting where the technical advantages of the software can deliver some distinctive performance. This different distribution of value between founding IP and accumulated founder-customer interaction contributes to the justification for different founding equity stake.”

USIT Software Guide

Many of this country’s most successful technology firms – Solexa, Oxford Nanopore, Synathesia – started off as spinouts from a university.

A Government review of the sector found that UK university spin-out investment increased five-fold from £1.06 billion in 2014 to £5.3 billion in 2021.

The new USIT Software Guide provides a common approach to negotiations across the sector to make the process much more efficient, especially for less experienced parties.

This includes a recommendation for university technology transfer offices (TTOs) to take between 5-10% equity in software spinouts.

The guide reflects the unique characteristics of software spinouts if compared with those in the life sciences and deep tech, including shorter development times, relatively low initial funding, and the need for rapid growth in a highly competitive, rapidly evolving market.

The landing zone includes a founder equity range of 90-95% and university royalty levels ranging between 0-2%, depending on IP and resource cost.

“Maximising the real-world impact of cutting-edge university research is crucial to advancing the UK’s reputation as a world leader for innovation. The new USIT for Software Guide demonstrates the sector’s continued commitment to building stronger relationships between TTO offices of leading universities, investors and founders, for the benefit of spin-outs, the economy and society.” Simon Hepworth, Director of Enterprise, Imperial College, London and Chair of USIT for Software

“With software spin-outs – more than many other spin-outs that we help set up – speed is of the essence. The ability to agree terms to enable founders to get their software solutions to market quickly is essential. Having this clear framework helps hugely in setting expectations on all sides and allows founders to do what they do best – create great software innovations that have real world impact.” Dr Anne Lane, Chief Executive, UCL Business

“There is so much exciting potential within UK universities. If we are going to continue building the dominance of UK technologies, we need to make it as easy as possible for investors and academics to come together and establish companies. We have listened carefully to the investment community and this guide is built on their feedback. A critical factor for success of a software start-up in addition to the visionary founders, is speed. The faster a minimum viable product (MVP) can be tested and launched, the faster the product can go to market, generate recurring revenues at scale and deliver returns to the investors and other shareholders in university software spin-outs. So, we hope this blueprint will encourage more investors from across the world to see the opportunity in the UK innovation ecosystem.” Kerry Baldwin, Managing Partner, IQ Capital

“Founders who are meaningfully incentivised to spin out and grow their companies are at the heart of a successful innovation and entrepreneurship ecosystem. The ease of the spin-out process matters greatly. USIT for Software offers a framework for enhancing transparency and aims to enable more effective collaboration between the university, VCs, and founders.” Ana Avaliani, Royal Academy of Engineering

Contributors representing universities, investors, law firms and other bodies engaged in the development of the guide, including seven round table sessions with representatives from the technology transfer offices of the universities of Cambridge, Edinburgh, Imperial, Manchester, Oxford and UCL, and investment firms Oxford Science Enterprises and Cambridge Innovation Capital, IQ Capital, LocalGlobe, and Octopus Ventures; deep dive sessions with round table sub-groups and lawyers from Goodwin Procter, Taylor Wessing and Venner Shipley; and consultation meetings with the BVCA, PraxisAuril and the Royal Academy of Engineers.

A new fast track equity model in Cambridge

Earlier this month the University of Cambridge launched a new opt-in fast track equity model that sits alongside Cambridge’s unique and pro-entrepreneurship intellectual property (IP) policy, to simplify and speed up the legal process to spin-out creation.

The offer allows for an immediate agreement on the equity portion of an IP licence to enable a spin-out and is structured to reflect the different circumstances of different businesses. This opt-in model will rapidly accelerate the time take to create a spin-out and provide greater support, enable greater impact from University research and improve the experience of our academic founders.

About TenU

TenU is an international collaboration formed to capture effective practices in research commercialisation and share these with governments and higher education communities. Its members work together to increase the societal impact of research.

Its members are the technology transfer offices of the University of Cambridge, Columbia University, University of Edinburgh, Imperial College London, KU Leuven, University of Manchester, MIT, University of Oxford, Stanford University, and University College London. TenU members work together to increase the societal impact of research.

TenU is funded by Research England and hosted by Cambridge Enterprise.

Tags: investment, software, TenU, USIT, USIT Guide