Impact story: The USIT Guide

Annual ReviewCommercialising research from UK universities is a significant part of the UK’s innovation and economic story.

The evidence is clear. The University of Cambridge has an annual economic impact in excess of £24 billion from associated research and innovation activity. More broadly, according to Beauhurst Data, during the past decade the number of annual spin-out deals has doubled to approximately 400 and investment has increased more than fivefold, to a total of £2.54 billion in 2021. This is not the data of an underperforming sector.

Public Debate

Despite such data there has been much public debate about university spin-outs this year and how more can be achieved. The finger of blame is frequently pointed at university technology transfer offices and particularly at the equity share taken in new businesses, together with the licensing policies and royalties, when a new company that is built around university research is formed. We are told that if universities were to ask for a lower equity stake, it would transform how spin-outs are created and unlock a wave of research commercialisation. On this basis, the Chancellor recently announced a review of how UK universities translate research into commercial success.

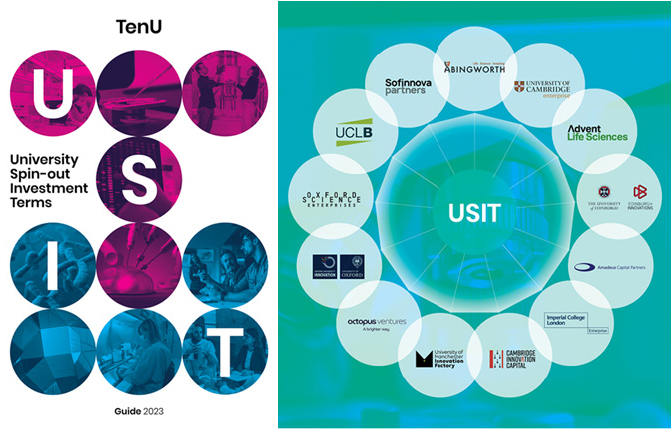

Creation of the USIT Guide

To contribute to the shaping of this policy debate Cambridge Enterprise, in partnership with the UK’s five other leading technology transfer offices and a group of prominent venture capitalists including Abingworth, Advent Life Sciences, Amadeus Capital Partners, Cambridge Innovation Capital, Octopus Ventures, Oxford Science Enterprises and Sofinnova, under the stewardship of TenU, have created a new University Spin-out Investment Template (USIT Guide). We believe it could be profoundly important and a critical tool in transforming research commercialisation in the UK.

The USIT Guide initiative

The USIT Guide will facilitate faster negotiations, make it easier to attract more investment and enable the creation of more spin-outs. It demonstrates the shared commitment across both the university and the venture capital communities to work together to build businesses that can change the world. Although the USIT Guide clearly recommends that all deals should be considered on their own merits, we proposed a landing zone for most spin-out deals. An equity stake in the range of 10-25% and a royalty in the range of 0-5% based on the maturity and market readiness of the technology. We know these deals are acceptable to founders, inventors, universities and critically investors. This is a major breakthrough. It will differentiate the UK from other countries and attract international capital. Experienced investors and universities now agree on how to accelerate the creation of spin-outs with deals that are fair to all stakeholders.

“The USIT Guide has come out of the deep professionalism and commitment of UK tech transfer offices to collaboration: sharing approaches internationally, and working with others – particularly investors – to make our ecosystem more effective.”

Professor Dame Jessica Corner,

Executive Chair, Research England

Support for success

We know from experience that creating spin-outs is daunting. It is challenging to take a new and sometimes-unproven technology with no customers, no revenue and potentially no market, and turn it into a high growth business. Academic founders can’t and shouldn’t be expected to do this alone – they need the support of experienced investors, including from outside the UK, if they are to mature, to flourish and to drive our economy forward.

The USIT initiative goes a long way to overcoming these challenges and making the vision of a UK science superpower a reality. Cambridge is proud to have played an important role in its delivery.

Related: Global University Venturing Podcast: The USIT Guide in International Perspective

Annual Review 2022

This impact story was first published in the Cambridge Enterprise Annual Review 2022.

View our Annual Review 2022 to learn more about some of the exciting breakthroughs and innovations that we have been part of during 2021-2022.