Impact story: Sustainability at Cambridge Enterprise

Annual ReviewIn 2021, Cambridge Enterprise launched a Sustainability Initiative as part of the University’s leadership on and commitment to Net Zero.

As part of this drive, Cambridge Enterprise will invest up to £10 million in 15 new businesses addressing a key subset of the United Nations Sustainable Development Goals.

Since 2020, Cambridge Enterprise has invested over £3.5 million into our Sustainability portfolio from our University Venture Fund, and these investments have been matched by the University of Cambridge Enterprise Fund managed by Parkwalk Advisors. In the past year, we made significant investments in Sustainability companies at several different stages of their fundraising journey.

Echion Technologies

We started the year with our continued support for battery material company, Echion Technologies. Its patented electrode material will enable faster recharging and longer-lasting lithium-ion batteries. In August we co-invested, alongside the BGF and the Brazilian multi-national, CBMM, in Echion’s £9.5 million Series A round, having previously invested in its pre-seed and seed rounds.

Carbon Re

In October, Cambridge Enterprise joined in a £1 million first investment into Carbon Re, a joint spinout with UCL (University College London) with co-investors the Clean Growth Fund and the UCL Technology Fund. Carbon Re uses a deep reinforcement learning AI platform to reduce carbon emissions in energy intensive industries like cement, steel and glass. The company has deployed its Delta Zero platform in cement plants on three continents and their pilots have already prevented over 10,000 tonnes of CO2 equivalents, demonstrating the platform’s value to its customers.

Carbon Re uses a deep reinforcement learning AI platform to reduce carbon emissions in energy intensive industries like cement, steel and glass.

Barocal

Barocal, a spinout from the laboratories of Professor Xavier Moya in Materials Science and Metallurgy, also raised its first investment round. Barocal has developed a solid material with the potential to replace all the powerful greenhouse gases used in refrigeration and heating. This patented barocaloric material which releases and absorbs heat at different pressures is more efficient, easier to recycle and does not risk the fugitive emissions from the industry that contribute significantly to the current greenhouse effect. In February, Cambridge Enterprise joined in a £1.3 million first investment into the company led by IP Group (now Kiko Ventures).

"Heating and cooling accounts for 38% of the UK’s CO₂ emissions and represents one of the most difficult sectors to decarbonise."

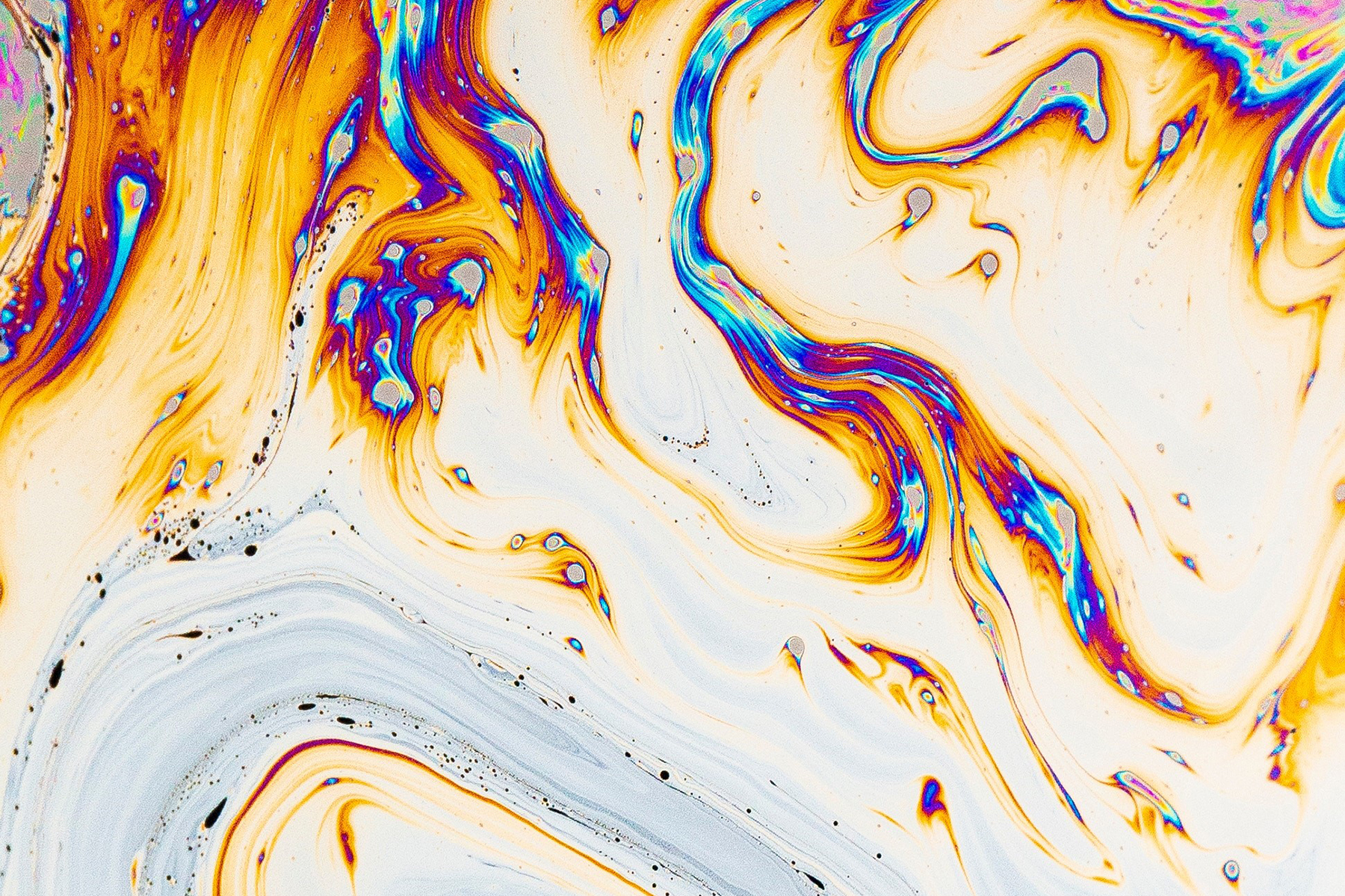

Colorifix

Cambridge Enterprise also participated with a great investor syndicate into a later stage round for Colorifix, the first company to use a biological process to produce, deposit and fix pigments onto textiles. Colorifix replaces all the industrial chemistry involved in the dyeing process with a natural, biological process. Cambridge Enterprise made earlier investments in Colorifix in 2020 and 2021, and in the summer of 2022 the company successfully raised an £18 million Series B round – including £400,000 from Cambridge Enterprise – to expand its operations in Europe and Asia.

Colorifix is the first company to use a biological process to produce, deposit and fix pigments onto textiles.

The Cambridge Enterprise team is very proud of the follow-on funding, and the total value of the companies within the Sustainability portfolio has grown to over £500 million. Two notable growth-stage investments include Nyobolt and Cambridge GaN Devices. Between them, these companies raised almost $80 million in later-stage investment rounds, and feature two of our female founders and CEOs, Professor Dame Clare Grey and Dr Giorgia Longobardi. We continue to build, support and follow our Sustainability portfolio with up to £10 million in equity investments, helping to create and fund the new businesses tackling the innovation gap needed to achieve Net Zero 2050.

Annual Review 2022

This impact story was first published in the Cambridge Enterprise Annual Review 2022.

View our Annual Review 2022 to learn more about some of the exciting breakthroughs and innovations that we have been part of during 2021-2022.