Phenomenal growth in less than a decade

10th anniversary storyCambridge Enterprise Seed Funds was the first to fund Horizon Discovery, making a £25k Pathfinder investment in 2007. At the time the gene-editing technology company had all of £9k in the bank, was head-quartered in an office at the Babraham Institute that used to be a toilet, and relied on the services of one PhD student.

This story was included in our innovation showcase for our 10th anniversary celebrations in 2016.

Today independent analysts set the value of Horizon Discovery Group plc‘s products and services business at up to £210 million.

Horizon Discovery started life as a translational genomics company. Founded in 2007 by Dr Chris Torrance and Prof Alberto Bardelli, they teamed up a few months later with Dr Darrin M Disley, following an introduction made by the former Head of Cambridge Enterprise Seed Funds, Dr Geraldine Rodgers.

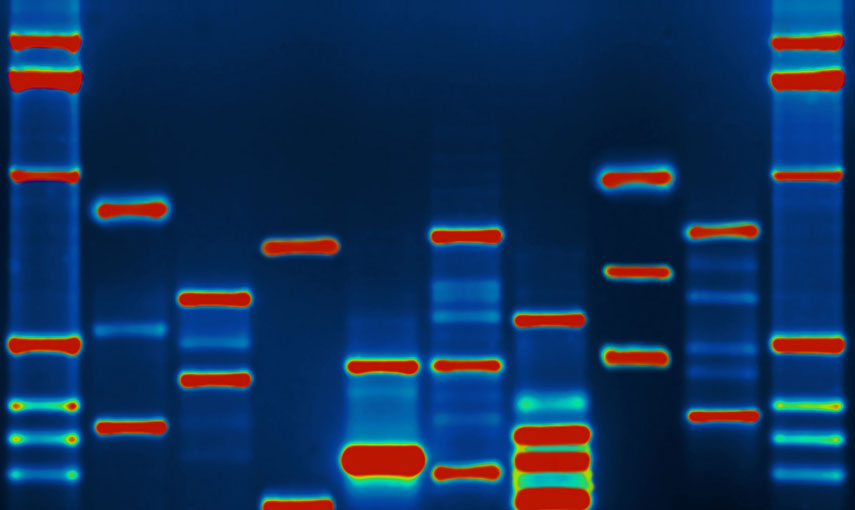

Their initial work converted raw DNA sequencing information into laboratory models that could be used by researchers to determine the genetic causes of diseases like Alzheimer’s, cystic fibrosis and cancer as well as to facilitate the discovery and development of drugs and companion tests that enable drugs to be developed and prescribed based on ‘patient-specific’ defects.

“Without the foresight of Cambridge Enterprise to back an orphan project in an area where all the technology came from the United States, Horizon would not have come into being”, said Dr Disley, CEO and President of Horizon Discovery. In fact Dr Disley credits the support of Dr Rodgers, who passed away last year, with being a major part of the reason Horizon holds its current world-leading position in the field of personalised medicine.

Public listing

Fast-forward to March 2014 when Horizon Discovery Group plc, now a leading provider of tools to support genomics research and the development of personalised medicines, was floated on the London Stock Exchange’s Alternative Investment Market (AIM). The company’s initial public offering (IPO) of £68.6 million was an all-time record for a life science company from the Cambridge Cluster. The stock market float also marked an impressive 30x investment return to the University. Dr Disley proudly explains “Horizon Discovery has always provided healthy returns to its investors on various investment rounds—all the way up to as much as 40X when the stock was at a high in 2015”.

Since the IPO, the company has acquired the former NASDAQ listed company CombinatoRx and SAGE Labs. The latter was an in vivo gene editing market leader founded in a management buyout from global life science company Sigma-Aldrich and Haplogen Genomics GmbH, a young Austrian company with a high-throughput gene editing platform. These acquisitions, made for about £40 million, have increased Horizon Discovery’s workforce to 300 across sites in Cambridge (UK) as well as Cambridge (Massachusetts); St. Louis, Missouri; Boyertown, Pennsylvania (all in the US) and Vienna, Austria.

A vision for the future

Today it is the aim of Horizon, which is headquartered in a brand new facility in Cambridge (the UK one), to become a fully-integrated life science company providing product, service and research biotech programs to every stage of the human healthcare continuum, from DNA sequence to patient treatment.

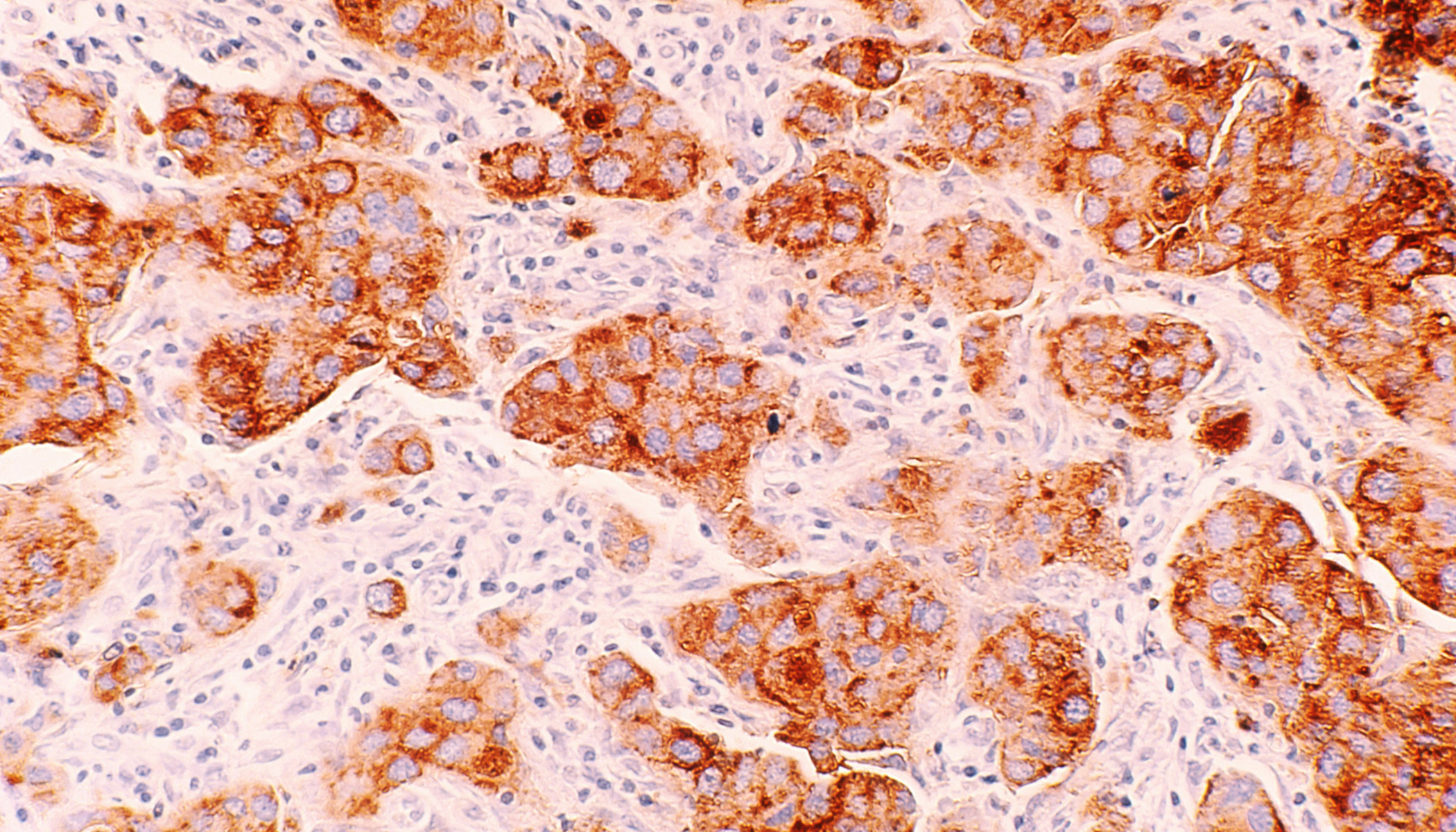

Horizon’s business is built around its proprietary translational genomics platform, GENESIS™, a suite of gene editing tools. Horizon has developed an extensive inventory of genetically-defined cell-line and associated reagent products that accurately model the disease-causing genetic anomalies found in humans. This technology can identify potential medicines targeted to patients with a specific genetic profile.

These products have been likened to a ‘patient in a test tube’ as they allow clinical outcomes to be predicted. Horizon has a customer base of over 1,600 organisations in over 50 countries, including major pharmaceutical, biotechnology and diagnostic companies, as well as leading academic research centres.

The company supplies its products and services into multiple markets, estimated to total in excess of £29 billion in 2015. Disley says that Horizon Discovery is currently operating at about a 2% market penetration of a specific available market of £1.2 billion. He adds that the company is excited about its immense growth potential.

In 2014 the company reported revenues of £11.8 million (77% growth); in 2015 £20.2 million (69% growth) and increased its market capitalisation from £45 million to a low-high range since float of £120 million to £210 million. All in all not a bad showing for a company that isn’t yet ten years old.