For the third consecutive year, the University of Cambridge has broken its early stage investment record, approving 13 seed fund investments for a total of £3.8 million, an increase on the £3.2 million invested in 2013-14. This new funding follows another successful year highlighted by the exit of X01 Limited, the developer of ichorcumab, an anticoagulant antibody with the potential to save millions of lives that was sold to Janssen Pharmaceuticals, Inc. During this period, the University received £3.7 million from realised investments.

The investment funds will move forward the progress of PhoreMost, a new-model drug discovery company that aims to develop drugs against targets previously thought to be ‘undruggable,’ Z-factor Limited, a drug discovery company created to identify and develop therapeutic agents to treat alpha-1-antitrypsin deficiency (one common manifestation of which is emphysema), Quethera, a gene therapy start-up developing a treatment for glaucoma that could prevent associated blindness, Cytora, a pioneer in the field of risk analysis technology and Reduse, whose cutting-edge ‘unprinter’ technology removes print from paper, dramatically cutting C02 emissions compared to recycling by reducing the need for pulping, heating and chemicals.

This record year for the University of Cambridge Seed Funds is particularly pleasing since it underscores the immense emphasis that the University places on innovation for the benefit of society across a wide range of scientific and technical endeavours.

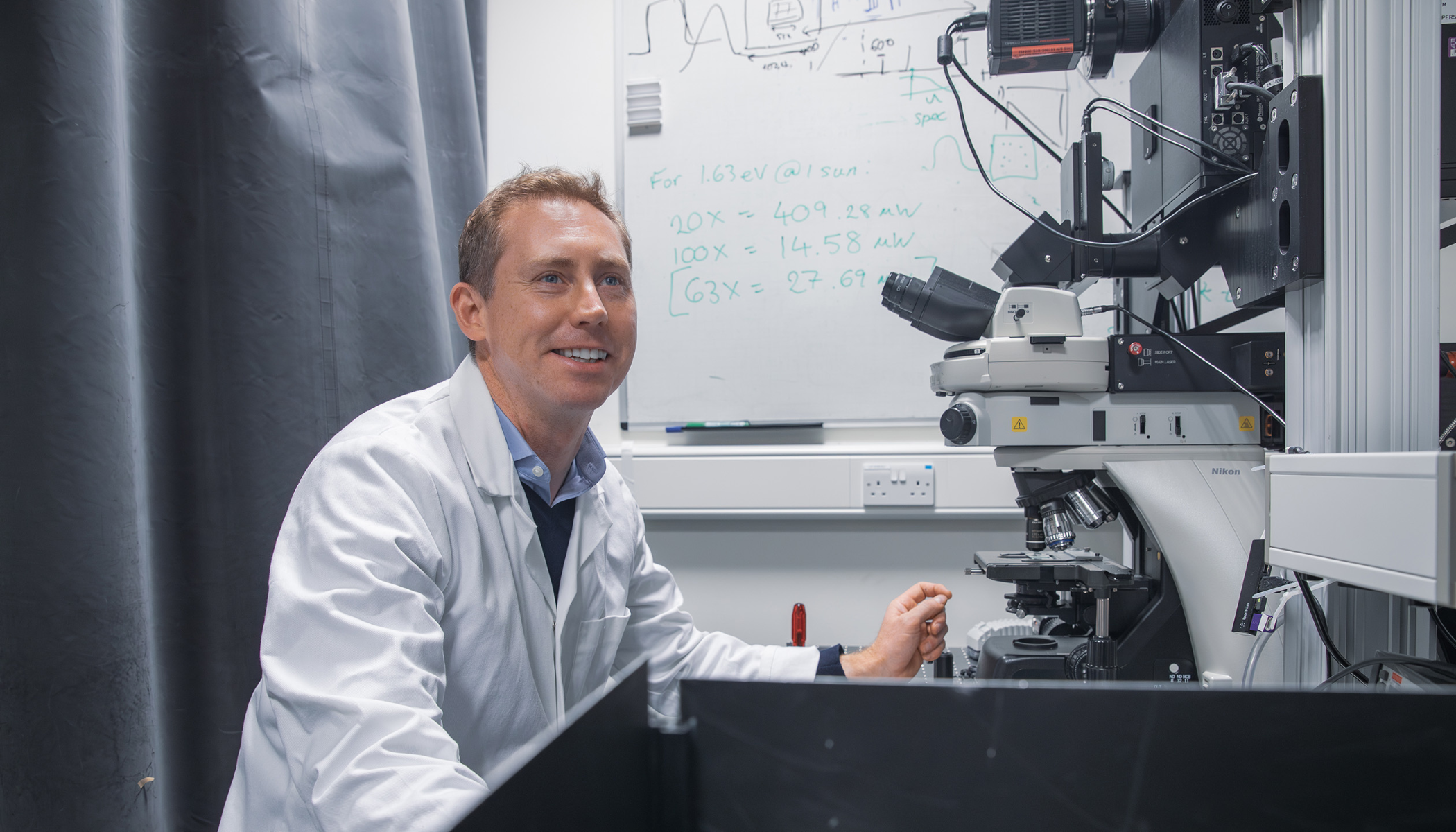

Professor Nigel Slater

Cambridge Enterprise, the University’s commercialisation arm, which is this year celebrating its 21st anniversary of University investment, manages two evergreen seed funds on the University’s behalf. Cambridge Enterprise also advises the University of Cambridge Enterprise Fund (UCEF), a combined Enterprise Investment Scheme (EIS) and Seed Enterprise Investment Scheme (SEIS) fund, which enables alumni and friends of the University to support Cambridge spin-outs while benefitting from generous tax incentives.

“This record year for the University of Cambridge Seed Funds is particularly pleasing since it underscores the immense emphasis that the University places on innovation for the benefit of society across a wide range of scientific and technical endeavours,” said Professor Nigel Slater, Pro-Vice-Chancellor for Enterprise and Regional Affairs.

This was the fourth year of operation for the Enterprise Fund, which was announced as part of the SEIS programme in the government’s 2012 budget, established to stimulate economic growth. UCEF III has invested £1.7 million across eight companies in a period of 18 months. The University is raising its fourth Enterprise Fund in February.

In addition to the Enterprise Fund, the University has approximately £16 million in seed funds available for investment. Through Cambridge Enterprise, the funds can provide pre-seed or seed funding.

Cambridge Enterprise Seed Funds provides links to management and sources of further funding. University portfolio companies have gone on to raise more than £1.4 billion in follow-on funding.