Fluidic Analytics Limited, a spinout from the University of Cambridge, has raised £1.56 million (US$2.4 million) in a Series A financing led by Cambridge Enterprise and including DFJ Esprit, IQ Capital, Parkwalk Advisors and Amadeus Capital Partners as co-investors.

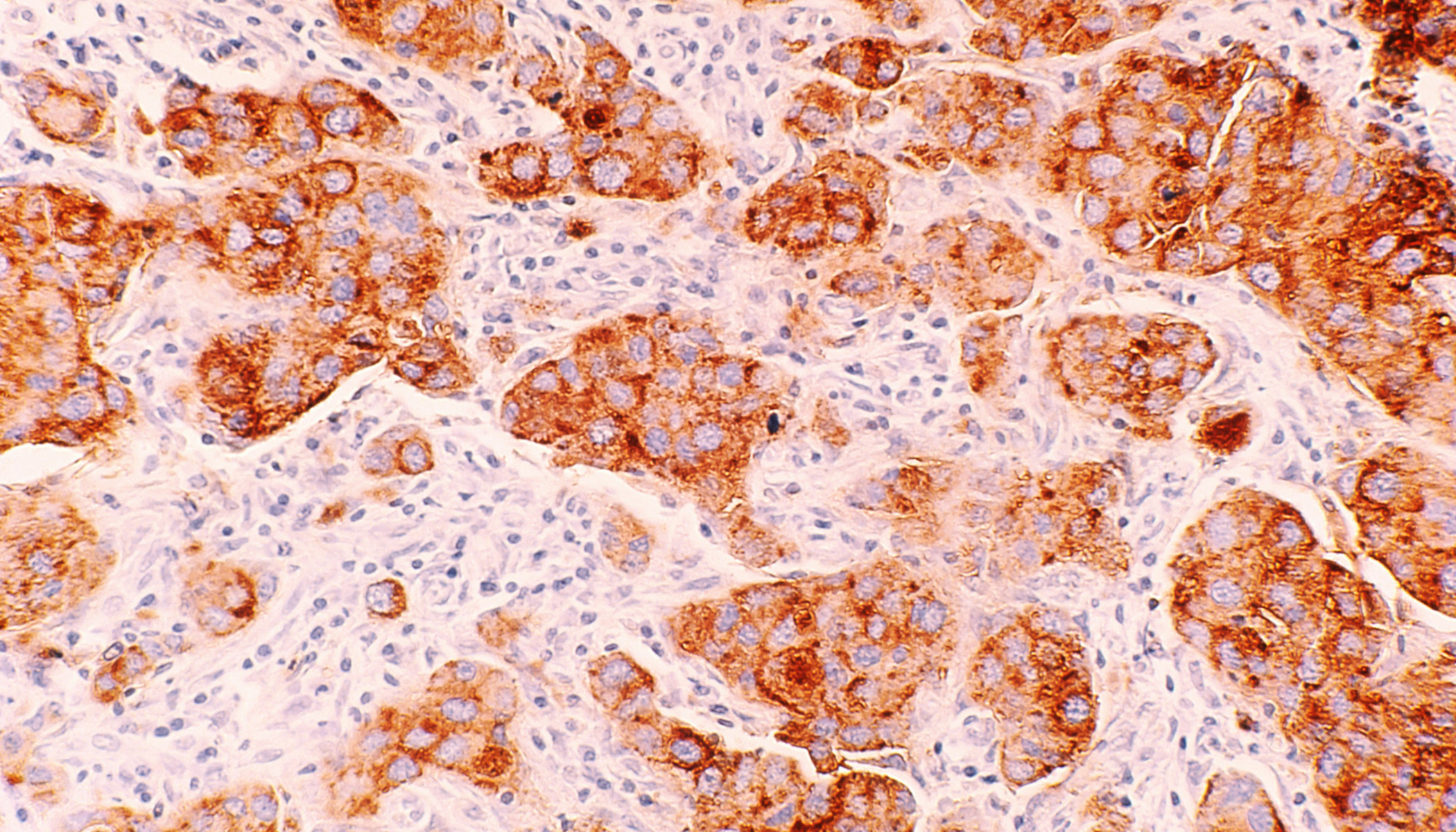

Fluidic Analytics has developed a proprietary technology to characterise proteins in a rapid, accurate and cost-effective manner. The technology is based on research conducted at the University of Cambridge and has high-value applications including identifying markers that indicate the onset of diseases in the human body.

In contrast to DNA, whose sequence provides information on the likelihood of developing a disease at some point in life, proteins provide real-time information on the actual, current disease state of the body. Real-time information on disease states is widely seen as the key to timely, effective medical treatment. The global market for protein-based medical-diagnostic tools exceeds three billion dollars annually.

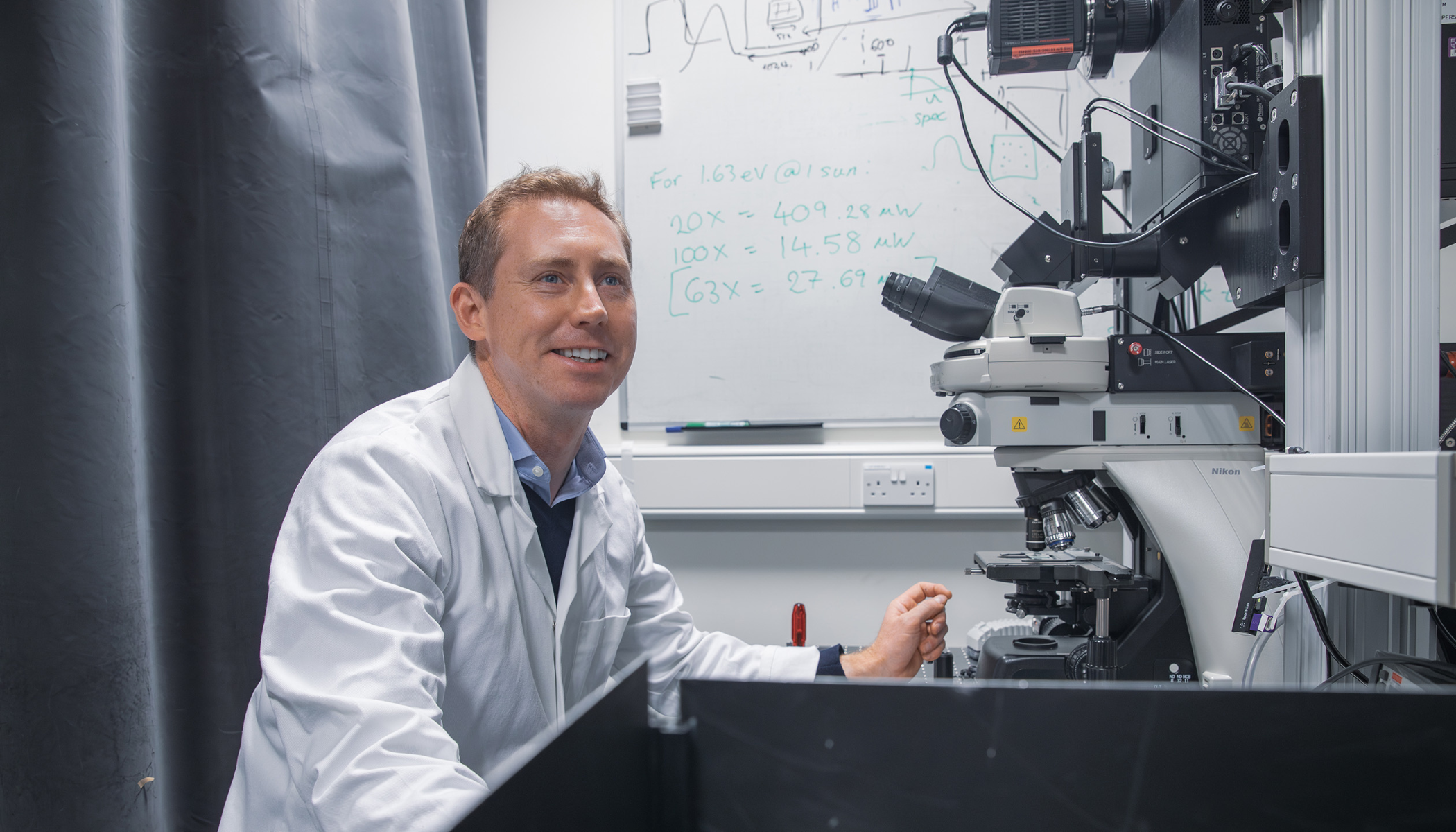

Fluidic Analytics was founded in 2013 by Dr Tuomas Knowles of the University’s Department of Chemistry. The company’s executive team is headed by serial entrepreneur Andrew Lynn, who previously led University spin-outs Orthomimetics and CamGaN to acquisitions in 2009 and 2012, respectively. Experienced life-sciences financier and director Anthony Colletta chairs the board of directors, which also includes corporate-finance and tax expert Colin Hailey as an independent non-executive director.

This financing will enable Fluidic Analytics to bring its first product swiftly to market and also allow us to make significant progress to capitalise on some of the exciting pipeline opportunities that our customers have helped us to identify.

Dr Andrew Lynn

Commenting on the investment, Fluidic Analytics CEO Dr Andrew Lynn said: “This financing will enable Fluidic Analytics to bring its first product swiftly to market and also allow us to make significant progress to capitalise on some of the exciting pipeline opportunities that our customers have helped us to identify. To welcome such a strong consortium of investors is a tremendous asset for our company’s long-term future.”

“Fluidic Analytics is an exciting example of the new generation of companies that can transform healthcare from being a data-poor industry to a data-rich industry,” said Vishal Gulati, DFJ Esprit, “Their novel and proprietary technology has the potential to make high-throughput protein analytics a reality. The availability of rapid, inexpensive and real time protein identification and analytics could make a dramatic difference in the way we maintain health and treat disease.”

“Fluidic Analytics perfectly illustrates how a University of Cambridge spinout supported by Cambridge Enterprise can merge the work of academics, entrepreneurs and early stage investors to bring potentially world-changing technology to market,” said Bradley Hardiman, Investment Manager at Cambridge Enterprise, the commercialisation arm of the University of Cambridge.

Vishal Gulati and Bradley Hardiman will join the Fluidic Analytics Board of Directors. Advisors for this transaction were Bracher Rawlins LLP, Confluence Tax LLP and Taylor Vinters LLP.